What to Consider Before Leasing a Car

Leasing a car can be a cheaper alternative to buying a car. It is like renting a house rather than buying a home. Leasing a vehicle will allow you to drive the car for a fixed number of months or miles, depending on the dealership. There are several car leasing advantages, but you need to consider a few things before signing a lease. Leasing a car is a long-term commitment. If you do not do research before leasing, you could wind up getting yourself in trouble. It would be best if you considered things like the lease’s mileage, lease specials, and the cost of the vehicle.

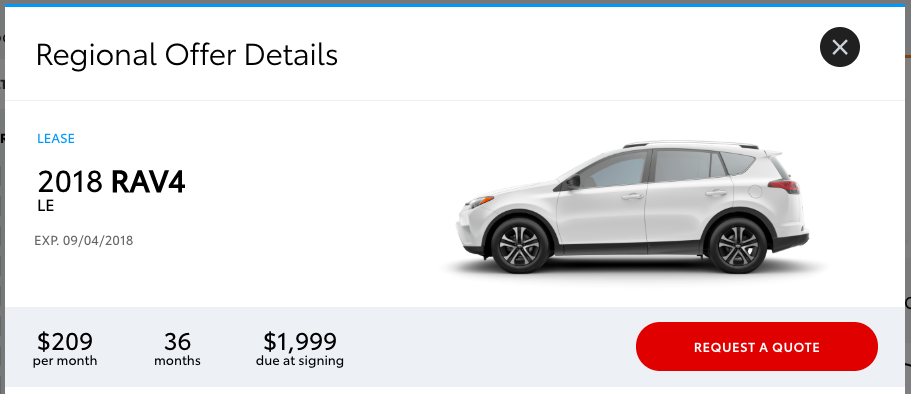

Check out the Lease Specials

Your first question when leasing a car should be: Are there any lease specials?

Lease specials could be a massive benefit to you. Many dealerships will offer a discounted lease in order to boost their sales. Not only does it increase their sales, but these specials could give you significant savings in your wallet, which is always a plus!

Many lease specials will advertise a meager monthly payment. However, the quoted monthly price rarely includes registration fees and sales tax. You should always check the fine print to avoid extra charges you may not know about.

How Much is the Drive-off fee?

Some leases require you to pay a high drive-off fee. The drive-off fee is a set amount of money you must pay to start your lease. Be aware of high or meager drive-off fees. You could get a high monthly payment with a $0 drive-off fee. Always ask the dealer about the drive-off fee, sometimes known as the “out the door” fee.

Most dealerships will only present a lease to current leaseholders or those with a high credit score. That said, it may be challenging to achieve. Do your research on the requirements of the lease first. Always ask the right questions to guarantee you will get something that benefits you.

Are there any mileage restrictions on the lease?

As stated earlier, always check the fine print. Most leases will have restrictions on the lease, such as mileage or overage charges. Almost every lease has mileage restrictions, commonly around 10,000 to 15,000 miles.

Checking the fine print could prevent you from paying more money than you would have in the first place. The fine print may state the dealership has an overage charge on miles. After hitting the miles limit, most dealerships will charge up to 30 cents per mile.

Before signing a lease, you need to know how many miles you will put on the car. You want to ensure that you stay within the agreed-upon mileage to avoid paying extra fees. Will you be driving over the mile limit in the following years of the lease?

Consider if you will be driving the car on long commutes or for short trips only. Going over your mileage limit could increase your monthly payment, which could end badly for you if you are in a money crunch.

Mile overage can also cause a depreciation of the car’s value, which could also increase your monthly payment.

Vehicle Cost

Along with the upfront costs of leasing a car, there will also be future expenses. It would be best to consider how much the vehicle will cost in the long run.

Maintenance, repairs, and monthly payments are all things you should consider before leasing a car. Cars cost money to run and operate. Without care and repair, you will end up paying lots more money in the end. You will need to pay more than just a monthly payment.

The monthly payment of leasing a car could be much lower than a monthly car loan payment. Drivers could save an average of $127 per monthly payment by leasing a car, an alternative to a car loan. Vantage Leasing could be your best bet.

Always remember to think about the immediate and future costs. You could wind up in a horrible spot without acknowledging the future costs. Leasing a car can be a massive advantage if you do the right things and ask the right questions.

Conclusion

In conclusion, you should consider several things prior to leasing a vehicle. Whether you think the cost of the car or the lease specials, it is all important! Always ask the right questions and thoroughly research before leasing a vehicle. Renting a car without the proper research could land you in a tight spot. No one wants to end up in a lease they are unhappy with!