What Costs More: New Car or Rent? The $1K a Month Car Payment Hit’s New Highs

[ad_1]

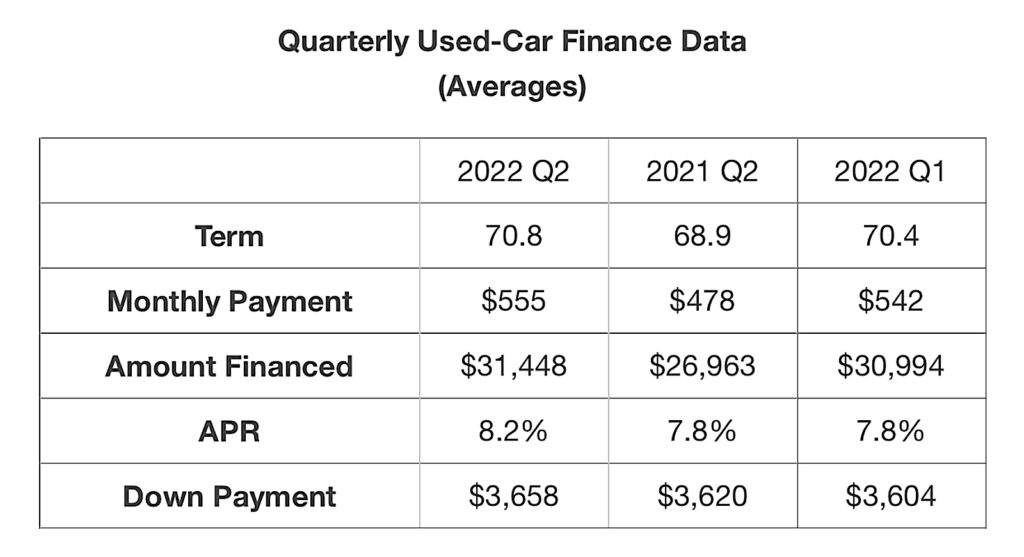

Seemingly just about every month delivers customers encounter-to-facial area with the prospect of paying out far more than at any time for a new vehicle. The month to month new car or truck payment not long back was a little more than $550 a thirty day period, now the average utilized car or truck payment is bigger than that.

Lately, in accordance to Cox Automotive, the ordinary regular payment for a new motor vehicle surpassed $700. On the other hand, with the Federal Reserve’s amount hike June 15, funding a new motor vehicle, truck or SUV for that also in close proximity to report cost exceeding $47,000 on regular just grew to become a lot more highly-priced.

No statistic reflects that improved than the truth that 12.7% of new car or truck prospective buyers who financed their invest in are now paying a lot more than $1,000 a thirty day period for that new motor vehicle. By comparison, the common rent payment in the U.S. proper now is $1,326 a thirty day period while the typical house loan payment is $2,064 on 30-year set home loan.

Why so much?

Some folks are paying just about as a great deal for what they push as exactly where they are living. Element of that is because of to mounting price ranges that have consistently established new highs thirty day period immediately after month for the previous 18 months. But also, folks are funding greater quantities to get these motor vehicles.

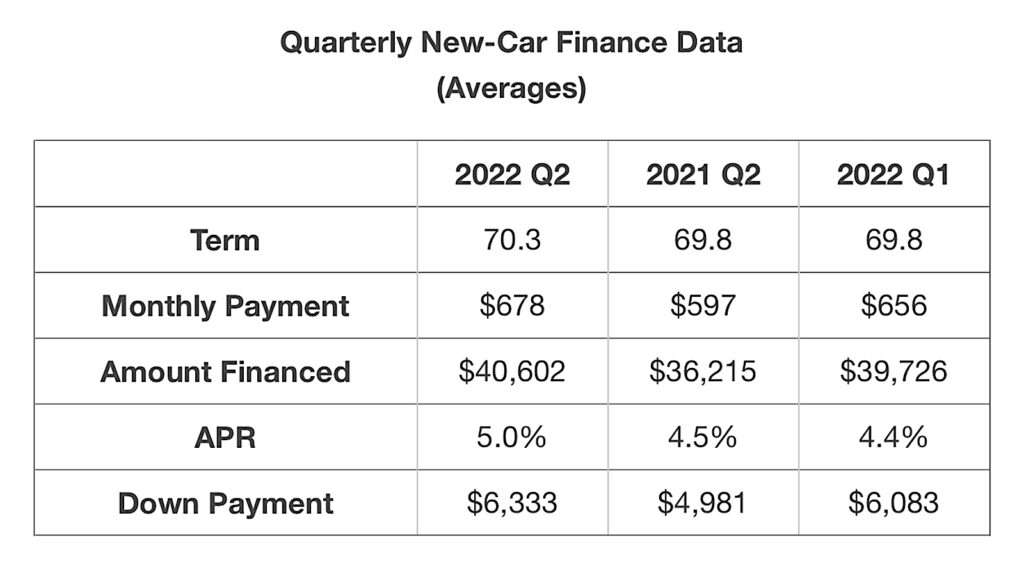

The normal amount financed for new autos hit a close to-report amount in the second quarter of 2022, climbing to $40,602 — when compared to $39,726 in Q1 2022 and $36,215 in Q2 2021, according to analysts at on the net procuring manual Edmunds.

The analysts note that the 1st and only other time that the common volume financed for new motor vehicles surpassed $40,000 was Q4 2021, when the regular yearly share level (APR) was just 4.1 %. Now the regular APR is 5%, a significant soar and bump in regular payment.

4-digit month-to-month note

The soar is likely, in some situations, for individuals monthly car or truck payments searching much more like hire payments. The selection of buyers sporting a $1K regular new vehicle payment has skyrocketed, accounting for just 7.3% of consumers in June 2021, 4.6% in June 2019 and a mere 2.1% in 2010, Edmunds famous.

“Low desire costs employed to be just one of number of reprieves for car buyers amid elevated costs and provide shortages. But the Fed amount hikes this yr are generating finance incentives much costlier for automakers, and customers are setting up to truly feel the pinch,” reported Jessica Caldwell, Edmunds’ executive director of insights.

“Although there seems to be a constant stream of affluent buyers prepared to dedicate to automobile payments that seem a lot more like property finance loan payments, for most customers the new car market is growing progressively out of attain.”

Other current market drivers

Another purpose for the leap in the normal selling price and payment is the rise of electric auto sales. Indeed, they are good for the planet and pleasurable to generate, but that comes at a price tag — a literal just one. The common mainstream vehicle charges about $43,000 while the regular EV exceeds $61,000.

In modern months, numerous car executives, together with CEOs, have been sounding the alarm about the truth that EVs are driving up rates and except one thing alterations, all of the promise EVs will be lost for the reason that no one can afford them.

Stellantis CMO Arnaud Deboeuf was the most up-to-date govt to ring the bell, warning of a complete “collapse” if BEVs are priced out of attain of the typical motorist. Previous December, Toyota CEO Akio Toyoda sounded a in the same way apocalyptic note in his function as the chairman of the Japan Automobile Producers Affiliation, or JAMA. Ford CEO Jim Farley and Deboeuf’s boss, CEO Carlos Tavares, issued related messages just lately.

But Stellantis CMO Debouef’s warning arrives at a time when the industry is dealing with critical shortages of critical EV parts, these kinds of as semiconductor chips, that have begun driving up expenses. And even if people accept the require to change from gas and diesel to electric powered autos, “the current market will collapse” if the sector cannot deliver rates beneath handle, he warned. “It’s a large challenge,” he claimed, according to Bloomberg information.

[ad_2]

Supply hyperlink