Demystifying Road Tax in Malaysia: Insights and Guidelines

In the intricate realm of motoring in Malaysia, one term reigns supreme – road tax. From understanding the nuances of road tax 1.3 to deciphering the dynamics of road tax 2.0 price and embracing the convenience of road tax checking online, this comprehensive guide unveils the vital aspects of road tax in Malaysia.

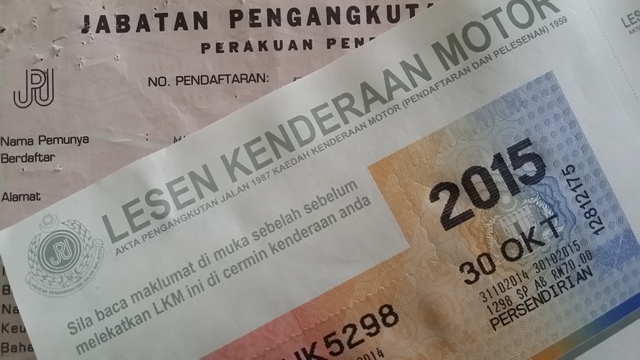

The Essence of Road Tax

Road Tax 1.3 and Beyond

Road tax is the financial commitment all vehicle owners in Malaysia must bear. It’s the fee that grants you the privilege of navigating the nation’s roads legally. The classification of your road tax depends on the engine displacement of your vehicle, commonly expressed in liters. Hence, the reference to road tax 1.3, for instance, points to vehicles with an engine capacity of 1.3 liters.

Calculating Road Tax 2.0 Price

The calculation of road tax 2.0 price isn’t shrouded in mystery. It’s primarily determined by the engine capacity and type of fuel used by your vehicle. In addition, the age of your vehicle is also a contributing factor.

For instance, vehicles with smaller engines are often favored by budget-conscious drivers, as they usually incur lower road tax fees. On the flip side, high-performance vehicles with larger engine capacities might incur substantially higher road tax costs.

The Online Advantage: Road Tax Checking Online

Convenience at Your Fingertips

In an age of digital transformation, the convenience of road tax checking online cannot be overstated. Gone are the days of queuing up at government offices or sifting through piles of paperwork. Now, with a few clicks, you can effortlessly verify the status of your road tax, ensuring it remains up to date.

Step-by-Step Road Tax Verification

Checking your road tax online is a straightforward process:

- Access the Relevant Portal: Visit the official website designated for road tax verification.

- Enter Vehicle Details: Input essential details, including your vehicle’s registration number and engine capacity.

- Verify and Pay: The portal will display your road tax status and the amount due. You can conveniently settle the payment online, saving you time and effort.

- Print the Receipt: Once your payment is confirmed, don’t forget to print the receipt for your records. It serves as proof of payment and legality on the road.

The Road Tax Renewal Cycle

Annual Renewal Ritual

For most vehicle owners in Malaysia, road tax renewal is an annual ritual. It’s not merely a financial obligation but a legal necessity. The renewal process often coincides with your vehicle’s insurance renewal, making it a practical approach to ensure compliance.

Grace Periods and Penalties

Keep in mind that there is a grace period for road tax renewal, usually up to one month after its expiration. Failing to renew your road tax within this timeframe can result in penalties, including fines and even the impoundment of your vehicle.

Special Considerations and Exemptions

Hybrid and Electric Vehicles

In a concerted effort to promote environmentally friendly vehicles, Malaysia offers reduced road tax rates for hybrid and electric vehicles. This incentive aims to encourage the adoption of eco-conscious transportation options.

Government Vehicles and Exemptions

Government-owned vehicles and certain categories of vehicles are exempt from road tax. These exemptions are typically specified in the Road Transport Act of Malaysia. It’s essential to be aware of the criteria governing these exemptions to avoid any inadvertent violations.

Conclusion

Road tax in Malaysia is not merely a financial obligation but a vital aspect of responsible vehicle ownership. From understanding the specifics of road tax 1.3 and road tax 2.0 price to embracing the convenience of road tax checking online, this guide equips you with the knowledge needed to navigate the intricacies of road tax regulations.

In a digital age where convenience reigns supreme, the option of road tax checking online offers a seamless experience for vehicle owners. The annual ritual of road tax renewal need not be a cumbersome task; rather, it can be a straightforward online process.

Ultimately, understanding road tax in Malaysia empowers you to ensure your vehicle remains legally compliant while enjoying the freedom of the open road.